COVER FEATURE

Impact of US Meltdown on Indian Economy : A Quick Assessment

B Shivaraman

The Spreading Economic Contagion: A Reluctant Recognition

Indian economy is insulated from the crisis…The global financial crisis will not affect us much…First Chidambaram went on in this vein until both he and his boss Manmohan had to reluctantly admit that no developing economy could possibly remain immune to the global crisis. Still, it was projected primarily as a financial crisis or at best a precursor to a mild recession. But no financial crisis is ever a mere crisis of the world of high finance alone. Just as the gloom in the trading floors soon spread to the shopfloors in the factories, financial turbulence is just a symptom of the turmoil in the real economy.

In a global crisis of such historic proportion where the total bailout packages by all countries work out to some 3 trillion dollars but where there is still uncertainty whether the system can be salvaged, it is stupid to pretend that India would be immune to the systemic crisis. A finance minister’s job is not to give false hopes. Panic at the stock markets cannot be prevented for long with pep words from the FM. Till October 14, the Bush administration alone has announced bailout packages to the tune of over USD 990 billion apart from injecting fresh investment worth $200 billion in banks and private financial institutions to shore up their financial position.

The contagion is truly global in a globalised world. How can the high priests of globalisation in India expect to insulate the country from this all-pervasive crisis?! Already the financial crunch is having its impact on the FII hot money in India. Just wait for the impact on trade, FDI, exchange rates, remittances, BoP, forex reserves and, above all, on the macro-economy in India. Goodbye to the rosy stories of double-digit ‘growth miracle’, it is now an impending debacle that stares economic analysts in the face.

The possible social impact is mindboggling. The new middle class in India is witnessing its first financial meltdown and a possible deep recession. The IT-BPO myth would soon be blown. The possible BPO gains could hardly make up for the IT sector losses inflicted by recessionary economies in the developed world. Anyway, if the job losses are already running into lakhs in the US, one can well imagine how much political pressure will build up there against outsourcing. If such leading names like Morgan Stanley, Merrill Lynch, JP Morgan, Goldman Sachs and Lehman Brothers start biting dust and their brightest kids are given unceremonious marching orders, Indian B-school products are surely in for a bad patch. Pre-election political pressure may have forced Jet Airways to take back its decision to terminate 1900 employees, but the job scenario in the so-called high-growth high-wage sectors has already turned gloomy.

All booms as in India, based primarily on foreign money, will soon go bust. The recession-ridden US consumer/industry can hardly sustain the growth miracles of China and India. The surpluses of the Indian bourgeoisie would find a greener pastures in greater and greater acquisitions abroad than investing anew in a dwindling economy at home. Didn’t the Swiss bankers’ association point out a few months back that Indians were holding $1.4 trillion in Swiss banks? A sum about 40% larger than the GDP! The only breed that will thrive is the breed of speculators — in stock markets, currency trade and possibly in the real estate, gold and art pieces where the desperate wealth would flow.

In US, if it was first the speculative housing market bubble/subprime and then the financial bubble, in India it has just begun with the stock market bubble and possibly the real estate bubble. When it extends to the investment bubble (what with the SEZs and other fabulous concessions, the telecom bubble, the IT-BPO bubble and so on), all claims of India having weathered the storm would wither. India perhaps might go under late and might take longer than the rest of the world to come out. All over the world there are 77 tax havens like St. Kitts and Cayman Islands. But in India there are 580 SEZs!

THE IMMEDIATE IMPACT ON INDIAN STOCK MARKETS

The festival season in India was seldom so gloomy for the share market. Investor wealth worth Rs.2.50.000 crore was wiped out on the bourses on a single day, on 10 October. The SENSEX fell by 1000 points before recovering some 200 points, an intra-day drop of some 800 points. The lachrymal wave washed away the festive mood.

At the first sign of stock market crash and FII funds stampede, the UPA Government has once again permitted P-notes (participatory notes) paving the way for enhanced speculation. The present convulsion in the Indian bourses would look mild before any possible explosion in future as a result of this heightened speculation. Despite the government itself acknowledging that the P-notes were being abused/misused at the time of banning them, no safeguard has been put in place. Anyway, how can there be any safeguard within the realm of speculations? It is absurd.

IMPACT ON INDIAN BANKS

“Indian banks are safe,” reassured RBI Governor Subbarao repeatedly. Indian banks' exposure to international markets is relatively small at 6 percent of their total assets, the rating agency Crisil said, adding that even lenders with large international operations have less than 11 percent of their assets overseas. But a mini-version Indian bailout was in the making simultaneously in the first week of October with the government virtually shoring up two mutual funds and LIC coming to the urgent rescue of three more which landed into liquidity crisis in the backdrop of a steep crash in the stock markets.

At a time when the big names in Western banking industry are queuing up for bailouts, there may be a sudden leap in NRI deposits in Indian banks as these funds would look for a safe haven back home. We can hence expect a big clamour from the NRI lobby for greater concessions for their deposits. Chidambaram would only be too willing to oblige. The RBI recently increased the credit cost on term borrowings (with more than 7-year maturity) to Libor+4.5% and even then the big Indian corporate names are finding it difficult to raise funds amidst the present turmoil. Indian borrowers will end up paying more for the foreign lenders and Indian banks might be forced to pay more for the NRIs – all in the backdrop of a creeping recession and falling rate of profits.

Even when Chidambaram was preparing to pass some 66 reforms-related pending Bills in possibly the last session of the parliament and a committee had prepared a blueprint for major financial sector reforms, the US financial crisis fell like a bombshell. No doubt, the UPA ideologues would also use the global meltdown as a pretext to push the same risky reforms. In the years to come, as the new investment projects go under one after the other and investors and insurance companies and hedge funds go under trading in credit default swaps and all such devices, the financial crisis here in India might be the denouement rather than the beginning as in US. ICICI, the symbol of new breed of unscrupulous financial manipulators, is already in doldrums.

Financial Fall Timeline

Washington - The crisis in world financial markets began when prices started declining in the US real estate market in late 2006. So far, it is estimated that banks worldwide have had to write-down more than 550 billion dollars in assets. Here is a chronology of major events:

- March/April 2007: New Century Financial corporation stops making new loans as the practice of giving high risk mortgage loans to people with bad credit histories becomes a problem.

The International Monetary Fund (IMF) warns of risks to global financial markets from weakened US home mortgage market.

- June 2007: Alarm bells ring on Wall Street as two hedge funds of New York investment bank Bear Stearns lurch to the brink of collapse because of their extensive investments in mortgage-backed securities.

- July/August 2007: German banks with bad investments in the US real estate market are caught up in the crisis, including IKB Deutsche Industriebank, Sachsen LB (Saxony State Bank) and BayernLB (Bavaria State Bank).

US President George W Bush rejects government intervention to ease the crisis in the home mortgage market and says he wants the market to work. He later pledges help for struggling homeowners to help ease the mortgage crisis.

Foreclosures of US homes in July were up 93 per cent from a year earlier, to 180,000 owners.

- September 2007: British bank Northern Rock is besieged by worried savers; British government and Bank of England guarantee the deposits; the bank is nationalised. US Federal Reserve (Fed) starts series of interest rate drops to ease impact of housing slump and mortgage crisis.

- October 2007: Profits at US financial giant Citigroup drop sharply. IMF lowers 2008 growth forecast for the euro area to 2.1 per cent from 2.5 per cent, in part because of spillover from the US subprime mortgage crisis and credit market crunch.

- December 2007: Bush unveils plan to help up to 1.2 million homeowners pay their loans.

- January 2008: Swiss banking giant UBS reports more than 18 billion dollars in writedowns due to exposure to US real estate market. In the US, Bank of America acquires Countrywide Financial, the country's biggest mortgage lender. Fed slashes interest rate by three quarters of a percentage point to 3.5 per cent following selloff on global markets. Another cut at month's end lowers it to 3 per cent.

-February 2008:Fannie Mae, the largest source of money for US home loans, reports a 3.55-billion-dollar loss for the fourth quarter of 2007, three times what had been expected.

- March 2008: On the verge of collapse and under pressure by the Fed, Bear Stearns is forced to accept a buyout by US investment bank JP Morgan Chase. The deal is backed by Fed loans of 30 billion dollars.

In Germany, Deutsche Bank reports a loss of 141 million euros for the first quarter of 2008, its first quarterly loss in five years. Fed spearheads coordinated push by world central banks to bolster global economic confidence by announcing moves to pump 200-billion- dollar liquidity into markets.

Carlyle Capital falls victim to US credit crisis as it defaults on 16.6 billion dollars ofindebtedness. US frees up another 200 billion dollars to back troubled Fannie Mae and Freddie Mac.

- April 2008: IMF projects 945-billion-dollar losses from financial crisis. G7 ministers agree to new wave of financial regulation to combat protracted financial crisis.

- June 2008: Home repossessions more than double as US housing crisis deepens. Bear Stearns execs join 400 charged with mortgage fraud.

- July 2008: California mortgage lender IndyMac collapses. Troubles for Fannie Mae and Freddie Mac continue to grow. US Treasury, Fed move to guarantee debts of Fannie, Freddie. Bush defends move, telling Americans to take a "deep breath" and have "confidence in the mortgage markets." US Congress gives final passage to multi-billion-dollar programme to address mortgage and foreclosure crisis.

Spain's largest property developer, Martinsa-Fadesa, declares insolvency.

- September 7: US government seizes control of Fannie, Freddie in 200-billion-dollar bail-out.

- September 15: Lehman Brothers investment bank declares 600- billion-dollar bankruptcy. Merrill Lynch acquired by Bank of America.

- September 17: US bails out AIG insurance giant for 85 billion dollars.

- September 19:White House requests 700-billion-dollar bail-out plan from Congress for all financial firms with bad mortgage securities to free up tightening credit flow.

- September 22: Last two standing investment banks, Morgan Stanley and Goldman Sachs, convert to bank holding companies.

- September 26: Feds seize Washington Mutual in largest-ever US bank failure.

- September 29: US House of Representatives rejects mammoth 700- billion-dollar bail-out plan.

- September 29: Governmental bail-outs announced for key banks in Britain, the Benelux and Germany as well as a state takeover of a bank in Iceland. British government intervenes to save major mortgage lender Bradford & Bingley. Netherlands, Belgium and Luxembourg to take over substantial parts of Belgian-Dutch banking and insurance company Fortis. German Finance Ministry announces that government and top banks were moving to inject billions of euros into troubled mortgage lender Hypo Real Estate. Iceland government and Glitnir bank announce state takeover of 75-per-cent stake in Glitnir.

- September 30: Wachovia Bank teeters on collapse, starts negotiating with Citigroup for takeover deal.

- October 1, 2008: US Senate adopts massive bail-out plan, adding sweeteners to get House acceptance.

- October 3: Wells Fargo bank and the fourth-largest US bank Wachovia Corp announce merger.

- October 3: The largest government intervention in capital markets in US history clears the US House of Representatives, becoming law with signature by President Bush. |

INCREASING LIQUIDITY

Liquidity position in India is comfortable, said RBI Governor Subbarao after a slew of measures. But he avoided hinting at any possible reduction in prime lending rates. The liquidity position may be comfortable, the banks and financial institutions might be slush with funds once again but with interest rates ruling high there is no pick up in the credit offtake by SMEs (small and medium enterprises). As they are the main employment providers in the industrial sector, the employment in this sector has already taken a heavy toll. A deep and prolonged recession in the West might result in unemployment for millions of these workers.

The RBI hurried to cut Cash Reserve Ratio by 150 basis points to 7.5 per cent, releasing more than $12 billion fresh liquidity into the Indian banking system. But if mere money supply alone can drive the economy and industrial growth forward uninterruptedly, then no economy will ever face any recession and there cannot be a meltdown of this nature. However, amidst all-round alarmism and panic reactions, confidence building itself has become the main plank of economic policy!

The government has once again liberalized ECB (external commercial borrowings by corporates). It is a different matter that in the light of the meltdown nobody would bother to take a second look at dollar bonds issued by Indian banks despite all their backing by the Indian government and hence they are abandoning the idea raising external funds/borrowings. While RBI might come forward to infuse liquidity liberally in the short-term, wait for the booming NPA figures in the medium and long term.

EXCHANGE RATE: Rupee Depreciation

When the western economies are going into a tailspin one after the other, the appreciation of dollar and euro looks somewhat paradoxical. From unprecedented appreciation earlier a few months back, the rupee fell to record low — reaching Rs.49 and odd per dollar at some point. The dollar is gaining vis-à-vis rupee because of the outflow of the FII funds and since the worst is yet to come in the US/global meltdown, a repeat of the East Asian crisis in India is very much a possibility. During the preceding period, if the rupee appreciated by around 18%, now it has depreciated by around 19% during this Jan-Sept.

The exporters who were crying earlier are happy but it now the turn of importers to come to grief. Not many people know or remember that manufacturing imports had overtaken total domestic manufacturing production in the domestic organised industrial sector this year. Apart from cost escalation and consequent reduction in profit margins, just wait for the impact of the rupee depreciation on inflation. The confident prediction of possible fall in inflation rate to single digit by January sounds hollow in the backdrop of this as well as the cut in CRR rates and other measures by the RBI aimed at increasing the liquidity.

IMPACT ON TRADE

The trade deficit is reaching alarming proportions. If exports are growing, imports are growing even more. Thanks to workers’ remittances, NRI deposits, FIIF investments and so on, the current account deficit at around $10 billion doesn’t look so threatening. But for some reasons if the remittances dry up and FIIs funds take flight, it will be a repetition of 1991 after a few years if forex reserves get depleted and trade deficits keep increasing at the present rate. Even as the country’s exports and imports registered a substantial growth 35.1 per cent and 37.7 per cent in dollar terms, respectively, during the first five months of the current fiscal (April to August), the trade deficit during the period has shot up. The trade deficit was around $14 billion for a single month of August 2008, a record level. Even Goldman Sachs’ prediction that India’s forex reserves would decline to $271 billion by year end from $310 billion in March 2008 looks a very conservative estimate.

Unprecedentedly high forex reserves were becoming a burden. As most of these funds were in dollars, the government had parked most of them in US treasury bonds or invested them in securities and bonds in foreign banks. With the meltdown and consequent poor returns following rate reduction, these treasury investments have taken a beating. The government had its fingers burnt with the earlier dollar depreciation. A part of these funds could have been used to clear some of the external borrowings. Now with the recovery of the dollar, repayment costs in rupee terms have also shot up. A golden opportunity was missed. The government was toying with the idea of establishing a wealth fund/SPV (Special Purpose Vehicle) with these reserves to finance private parties taking up infrastructure projects through PPP. But, despite all the hype, the PPP has been a total flop so far.

An Indian Recession?

It might be just a slowdown in India till now. But a recession cannot be ruled out in the medium term. Chidambaram is claiming 7.5—8% growth this year. ADB has predicted 7% growth. Many rating agencies have put it at 6.5%. Industrial growth is down to 5.2% from around 11-12% in 2006-07. It is hoped that agriculture would be the saving grace this year thanks to a good monsoon. But just recall that Chidambaram was boasting about a possible 10% growth early this year after the budget and the situation has changed!

True, there is a boom in FDI this year. The total FDI between April and August this fiscal stood at $14.6 billion. A record figure. Average monthly FDI inflow is above $2 billion whereas a few years back that was the annual figure. Kamal Nath was confidently asserting that the target of $35 billion for this year would be achieved. But a closer look reveals that a sizable chunk of this FDI going into mining loot, services, financial services in particular, entertainment industry including luxury hotels and so on and also on M&As not mainly to afresh investments in the core productive sectors alone. The long-term sustainability of such a pattern of FDI flow is anybody’s guess. Especially, in the midst of the global liquidity crunch. Inflows into already committed projects might give a false impression and it remains to be seen how long this boom will continue. To sustain it, Chidambaram is bound to come up with a slew of fresh liberalisation measures. FDI caps in insurance, banking and financial services are already being hiked. There might be 100% FDI in single-brand retail. There will be more and more sellouts to attract foreign capital. India, like China, will continue high growth despite recession in the developed countries, Chidambaram keeps repeating ad nauseam.

Well, if high growth is to be driven primarily by foreign capital assisted by government landgrab, tax waivers, assured returns guarantees for infrastructure investments and fabulous BOT terms and so on, in short, by making the whole of India into a tax haven, the structural distortions this Manmohan gamble would lead to is mindboggling. Leaving a handful of big business houses and Indian MNCs, nothing Indian would be left in the “Indian” economy. And even the “India” MNCs have started looking outward. India Inc spent $26 billion in mergers and acquisitions abroad this year. The global meltdown would, if anything, only accelerate this trend and the scarce capital resources would be channelized for overseas spending. If this is the story of overseas M&As by “Indian” companies, M&As in India by foreign companies is even more breathtaking. In power sector alone, the merger and acquisitions worked out to $5 billion out of a total M&A value of $55 billion in the infrastructure sector alone. This is the secret behind the high FDI. But overseas M&A is not a rosy path. Tatas teamed up with AIG which was one of the first to go under. TCS, Infosys and WIPRO…all were on an acquisition spree abroad but at home they are the leading ones in issuing pink slips.

The nation would soon realize the real cost of the N-deal. N-deal was also a sort of bailout for the US industry. Kakodkar has once again made it clear that 20 nuclear reactors would be set up! How in the given situation the governments would foot the bill in the next ten years?

‘Shining’ India Amongst the World’s Hungriest Nations

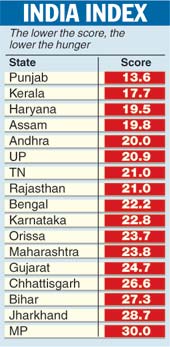

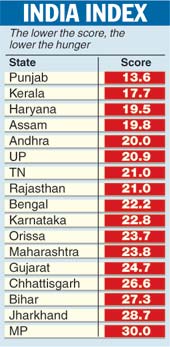

With over 200 million people who are food insecure, India is home to the largest number of hungry people in the world, according to the findings of the India State Hunger Index 2008. The ISHI findings highlight the continued overall severity of the hunger situation in India, while revealing the variability in hunger across states within the country.

Co-authored by the International Food Policy Research Institute, ISHI notes that not a single state in India is either low or moderate in terms of their hunger index scores; most states have a 'serious' hunger problem.

India has worse hunger levels than Sudan, Nigeria or Cameroon, India’s much-touted growth notwithstanding. The researchers classified a score of 10 to 19 as "severe", 20 to 29 as "alarming" and 30 and above as "extremely alarming".

Not only the ‘BIMARU’ MP, Jharkhand, Bihar and Chhattisgarh, but even the globalisation “success” story – Modi’s Gujarat – as well as CPI(M)-ruled West Bengal fall within the “alarming” category. Even the green revolution showpiece, Punjab, and other supposed development successes like Kerala and Haryana suffer from ‘severe’ hunger. |

The Deflating Growth Bubble

And what about the growth story? Well, the ratio of savings and investment to the GDP reportedly remains high at 35 per cent. So far so good. Still, there is a slowdown in the Indian economy. The core sector growth is down to less than 4 per cent. All vital productive sectors are on a slowdown. With such a structural background, if and when the Indian economy slips into a recession, the recession will be protracted and there will not be a quick revival. Crude oil prices have declined to $80 a barrel. The monsoon has been good in most parts of the country. For a couple of years it is not difficult to continue with the growth story. But infusion of liquidity, i.e., increasing the velocity of circulation alone in other words, can hardly sustain production. The basic structural flaws are bound to come back to the fore to haunt.

The problem might be made to look minor — as that of liquidity — at present but if there is a severe constraint in demand then no amount of infusion of money into the system and supply side magic would be able to save it. And given the fiscal scenario, the government would not be able to go for any fresh neo-Keynesian binge either, leave alone any major corporate bailout as in the US. Pay commissions and loan waivers might sustain aggregate demand for a couple of years but signs of slowdown are already on the wall. Despite repeated promptings of Chidambaram, the bankers are not ready to reduce even the home loan rates and not just the prime lending rate for the businesses. After all, they are hardnosed businessmen and they will continue to be top executives in their banks while Chidambaram and his party might go out of power.

The 11th Plan estimates that to maintain an average annual growth rate of 9%, the investment in infrastructure would have to rise from Rs.259,839 crore in 2007-08 to Rs.574,096 crore in 2011-12 at constant 2006-07 prices, aggregating to Rs.2,011,521 crore over five years. In the terminal year, this works out to be 9 per cent of the GDP, up from 5 per cent of the GDP in 2006-07. The Plan document itself says that the government cannot manage this much money and a substantial part of it has to come from the private sector. PPP is supposed to pave the way. But what is the record so far? The Government of India's Committee on Infrastructure which monitors PPPs notes that 244 PPP projects are ongoing and another 76 are in the pipeline in the country. The total capital outlay in the ongoing projects amount to a minor fraction of the total projection by the Planning Commission. To finance infrastructure projects, the GoI established an India Infrastructure Finance Company Limited (IIFCL), a wholly Government-owned company to provide long term finance for infrastructure projects. According to the IIFCL website, it would provide loans upto 20 per cent of the project cost and projects "awarded to a private sector company ... [a company established] through Public Private Partnership (PPP) shall have overriding priority". And how big is this IIFCL? The GoI has successfully persuaded the World Bank to give it a loan of a meagre Rs.2700 crore to finance projects worth Rs.2,011,521 crore! Making bogus projections to justify pro-private sector policy changes is the thriving industry in India. In such a situation, can any sizable fund flow into the risky infrastructure sector of a developing country amidst tottering private banks and investment funds?

Many approved SEZs are in doldrums as they are not getting any units and this whole thing is a massive real estate speculation of gigantic proportions. Even though the real estate speculation in India is taking a different trajectory and is not as reckless as credit instruments without any backing by collaterals as in the US subprime, the real estate bubble centering around SEZs landgrab is no less serious. Despite RBI’s reservations, the banks were competing to lend to SEZ promoters and even the nationalized public sector banks accumulating huge NPAs would be lined up for private takeover. SEZs might finally achieve what Narasimham’s two reports could not achieve. If millions of home loan borrowers are defaulters, the banks can take back their houses. Even they can takeover the SEZs. But if they themselves go deep into the red irretrievably, they themselves would be taken over. Companies incurring loss too would be taken over by stronger sharks. After a wave of takeovers, if the economy doesn’t revive, this would only amount to taking over the losses. A massive collapse in asset prices is the ultimate eventuality.

SOCIAL IMPACT

‘Suicides after market crash is an urban trend’ …screamed the headlines in a pink paper. Beneath that was the sob story of an entire family committing suicide after heavy loss in the stock market. “Whether it is a seemingly well-to-do US-resident of Indian origin wiping out his entire family or middle-aged brother-sister duo killing their parents and then committing suicide, the financial crisis has hit everyone, and has hit them hard”, the report added. At least, the desperate farmers go alone leaving their family members in the lurch. But the scorched middle class investors take their entire families along and that is the level of urban investing middle class insecurity. This explains the golden age for gold as investment in yellow metal is considered safer. Just think of the hundreds of new scrips by companies with ambitious investment plans counting on these investible surpluses of the middle classes and also the market opportunities opened up by their wealth. All these plans for new scrips will be scrapped. The middle class boom might be glamorous but the depression in incomes and losses in the markets are far more agonizing. Pink slips are painful indeed and joblosses are not limited to the West alone. Those who are hoping that jobs in the West would shift across to the cheaper shores of the India are missing the point that domestic job losses due to recession in the West as well as a slowdown in India would far outweigh such outsourcing gains. Even the real estate boom is going bust in Bangalore, the Indian Eldorado.

The Indian BPO sector derives 40 per cent of its revenues from the financial sector of the developed countries and exactly as they mushroomed fast they will wilt with the same speed. IT-BPO sector in India accounts for 5.5% of the GDP but 30% of exports and a very high share of service sector employment in cities like Bangalore. El Dorado is poised to turn into a hell!

Take the case of garments and textiles. Hardly a few months back, tens of thousands of workers, mostly women, were out of jobs in Chennai and Bangalore and towns like Tiruppur and Karur. The villain was the rupee appreciation, leading to some 18% reduction in incomes in rupee terms. After the loot by layers and layers of intermediaries, the factory producer was left with nothing and hence closed down the unit. Now dollar has appreciated, smile returned to the faces of garment owners but the smile soon vanished. The current exchange rate offers handsome returns but the orders are drying up due to impending recession. No margin then…no orders now! No jobs in both the scenarios.

The impact on the working class by means of wage compression and workloads, illegal retrenchment and worsening of job security and working conditions etc., would be onerous. Already this has started happening. For reasons of space, we are not elaborating. But we can only say there will be many more NOIDAs.

The employment in organised industrial sector – both public and private – was 8.98 million in 1997 but it was down to 7.62 million by 2005, i.e., precisely during the growth miracle if we leave out the disastrous year of 2001-02 for the industry when the growth was very low. If the growth miracle turns into a debacle what will happen to organised sector employment? Formal sector will be informalised and permanent workers will be booted out.

Bailouts for the bankrupt and boot-out for the workers. The same logic of capital! Total blackout of the possible social impact of the meltdown and almost virtual absence of any discourse on safety measures/nets is one of the characteristic features of the current crisis of capital, across the globe as well as in India.